AI-Powered Project Planning for Financial Services — Compliant and Predictable

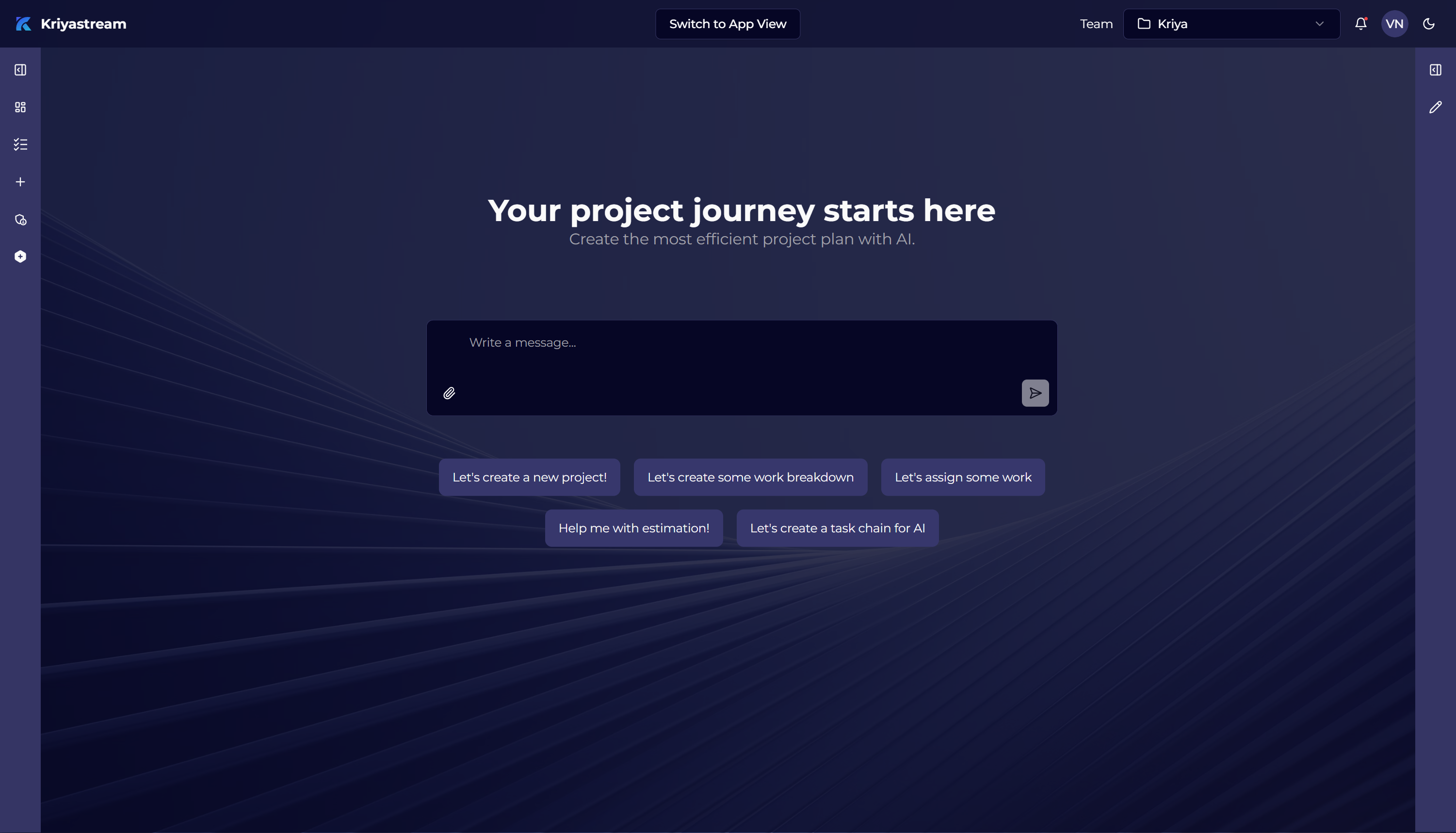

From regulatory compliance to digital transformation, Kriyastream helps banks, insurers, and financial institutions plan and deliver projects with accuracy and transparency.

The Challenges in Financial Services Projects

Financial institutions face complex, high-stakes projects that demand precision:

Over 70% of digital transformation initiatives in banking fail to meet objectives (BCG).

Regulatory compliance projects can consume 10–15% of IT budgets annually.

System migrations frequently run 20–40% over budget due to poor estimation.

Limited resource visibility slows delivery of growth and compliance initiatives.

Siloed teams and fragmented tools create costly delays and oversight gaps.

How Kriyastream Helps Financial Services Teams

Regulatory Compliance Templates

Standardize workflows for Basel III, SOX, GDPR, or local banking regs.

System Migration Forecasting

Accurately model costs for core banking, ERP, or trading platform upgrades.

Digital Transformation Planning

Build repeatable structures for cloud modernization and fintech integration.

Portfolio Cost Control

Monitor ROI and budget impact across compliance and innovation projects.

Key Benefits for Financial Services Organizations

- Improve estimation accuracy, reducing overruns by 15–25%.

- Accelerate delivery of compliance projects by 20–30% with standardized templates.

- Increase ROI on digital transformation initiatives by reducing failure risk.

- Gain transparency into costs across multi-year regulatory portfolios.

Deliver financial services projects with precision, compliance, and visibility — powered by AI-driven planning.

Signup opens soon. Join the waitlist to get early access.